Small businesses nurse $230k in pandemic stock hangover

A survey finds firms have thousands of dollars locked up in products accumulated when supply chains and transport networks were log-jammed.

Small businesses are nursing a stock hangover from the pandemic worth an average of $230,000 according a report by inventory management software specialist Unleashed.

Transport and supply issues during COVID had generated an oversupply and most SMEs had yet to course-correct, the company said.

“You can’t blame Australian businesses for taking on extra stock while supply chains were lagging behind,” said Unleashed head of product Jarrod Adam. “Thankfully, we are now in a place where we can safely define what too much stock is, and where businesses can afford to free up cashflow as economic conditions tighten.”

Unleashed analysed 148,142 products, ingredients and components stocked by 660 Australian SMEs and found an average of $231,700 in additional product or ingredients versus ideal stock levels. Ideal levels were calculated using industry-standard formulas that considered both the rate of sale and delivery lead times for individual items.

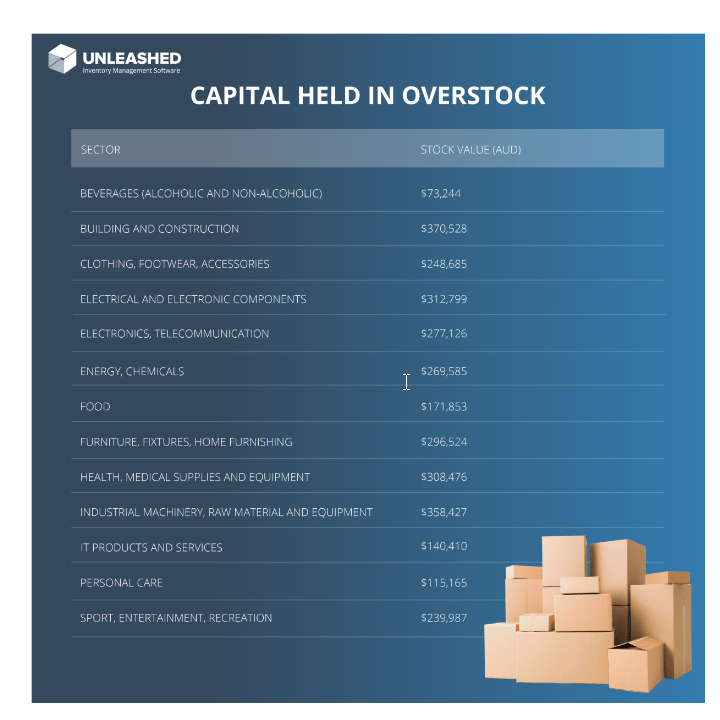

The figure varied from sector to sector, with personal care ($115,165) and beverage companies ($73,244) carrying the least overstock while

industrial machinery, raw material and equipment ($358,427), along with building and construction ($370,528) had the most.

Australian firms also had a higher average overstock position than those in NZ ($200,733) and the UK ($186,500) although were in a slightly better position than their North American peers ($236,391).

BDO senior manager Josh Ambler said high stock levels could creep up on a business due to a lack of visibility.

“Traditionally, there haven’t been great tools to identify overstocks or under- stocks, or be able to order just-in-time. Typically, people developed their own logic outside of systems to try manage that,” he said.

He said that broad-brush approach of the past was being replaced by more detailed analysis and clarity about a firm’s stock level could make a big difference to its cash position.

“There have been three or four tools come to the market that can do that at a very affordable price and so it’s changed the game for those small-medium wholesalers and retailers.”

He said some sectors, such as the wine industry, which had long experience with overstock had become good at dealing with it. However, sectors that operated on big margins or which relied on disposable income, such as luxury goods, could suffer.

“Comparing, say, beverages and construction, you’re often looking at very different inventory models. Unlocking cash from surplus inventory is way simpler if you have a short cashflow cycle – some relatively simple adjustments in resupply orders can quickly mean more cash in the back pocket,” Mr Ambler said.

“For businesses with a slow cashflow cycle, ordering will take place at set times or in higher volume to secure a good price. These companies may instead need to consider how they can move off excess stock before it comes obsolete.”

“We might see more businesses become made-to-order or what we’ve seen in the beverage industry, for example, is they don’t hold any stock at all – it’s all outsourced typically now.”

For photographic lighting retailer Hypop, this year has meant moving away from the just-in-case model used during COVID and back to just-in-time.

“During the pandemic our stock literally doubled as we tried to manage all of the delays from equipment purchased around the world — and sometimes that meant holding too much of the wrong thing,” said Hypop owner Rob Ranoa.

“This year we decided to start cutting down this excess inventory in order to move to a more stable operating model. That’s meant some sales and promotions, which can hurt in the short term, but leaves us in a far better position in the long run.”

Mr Adam said the report’s findings could make a real difference for businesses pressured by inflation and supply chain shocks.

“We know that unlocking cashflow is a priority for our customers ahead of this new financial year,” he said. “It’s all about finding ways to control the controllables – that can mean anything from improving internal efficiencies, to using a more granular, data-based approach to rebuying.”

Mr Ambler said expanding sales channels was a key strategy for tackling too much stock, especially when sales were slowing.

“The advice has always been look for other channels to market and a really good one at the moment is Amazon,” he said.

“Amazon Australia is maturing rapidly and is hungry for unique products. People maybe create a white label of their product, or a slightly different brand version of the product, and launch them to Amazon. It might be slightly discounted but it helps get volume.”

He said it could also open up fresh markets, and Australian and New Zealand businesseses had successfully launched into the US using the online sales giant.

Other traditional strategies were being revived, such as wholesalers cutting out the middleman and going direct to market with online websites.

Mr Ambler expected stock levels to return to normal levels as demand eased.

“People have to get clever around reducing their stock holdings but they certainly won’t be buying more than they need to,” he said.

“The supply chains are smoothing, freight charges are coming down, it’s all falling back into a normal routine … and now we’ll see reduced demand.”

The Unleashed report looked at the stock positions of 1,886 firms in Australia, NZ, the UK, the US and Canada, and calculated optimum levels for 381,000 individual product and component lines.

All the firms analysed were manufacturers, manufacturer wholesalers or manufacturer retailers with less than US$25 million in turnover.

Unleashed is cloud-based software that gives product businesses clarity and control across suppliers, production, inventory and sales. Founded in NZ in 2009, it was acquired by the UK’s Access Group in November 2020 and has thousands of users in more than 80 countries.