AI & Small Business: The Concerns, The Benefits, and The Tools

We frequently find ourselves being asked about the risks of AI & small business, and it's certainly not only our clients who are worried; a recent Xero report found that 80% of small businesses globally are concerned about the impact the rise of AI will have.

What Small Businesses Are Worried About:

The key concerns are whether AI development and adoption will outpace regulation, commoditise services, and ultimately take more and more jobs away from hardworking humans. But, as we tell our clients, it’s important to understand that AI is not some new and terrifying digital development; it’s been around for a long time. Machine learning dates back to the 1970s, and the algorithms have been around for many years; we’re just seeing AI more prominently now because computing power has increased.

5 Benefits of AI for Small Business

- The automation of routine tasks allows businesses to optimise their processes and reallocate human resources to a more impactful area.

- AI enhances task efficiency with rapid uptake and minimal training needs, enabling businesses to integrate advanced tech more easily.

- Workers are more empowered and job satisfaction is increased with AI’s removal of manual and remedial tasks.

- Automation is cost-effective; with technology's efficiencies, operational expenses can be vastly reduced and budgets can be freed up for more strategic investments.

- Businesses can acquire additional and diverse skills cost-effectively through AI technologies and their augmentation of human capabilities, ultimately building themselves a competitive edge.

5 of our Favourite AI Tools:

ConverSight:

Positioned for the next generation of business leaders, this platform aims to humanise the interaction between people and data. It uses conversational AI to help empower decision making.

Aider:

This AI-driven finance assistant is clear that it wants to “not let AI replace accountants and bookkeepers”; instead it’s designed to help small businesses complete “the admin you don't want to do”.

Zia (by Zoho):

Zia bills itself as the AI-powered assistant for business. Developed by Zoho, it’s embedded in their suite of applications and strives to enhance productivity by automating tasks, offering insights and facilitating smarter business operations.

UiPath:

This enterprise player, which counts juggernauts like Canon and EY as customers, is a leading robotic process automation (RPA) platform that leverages AI to complete repetitive tasks and streamline workflows.

Superhuman:

Promising users “get four hours back every week”, this is an AI-powered platform that aims to revolutionise the way we communicate through email. The high-performing teams it counts as clients include Netflix, Harvard University, Spotify and many others.

Cracking the Code: B2B eCommerce Explained

What is B2B eCommerce?

As the name suggests, this form of online trading is focused around platforms designed exclusively for businesses transacting with one another. B2B eCommerce involves dedicated websites or portals where 'on-account' or B2B customers can place orders with their suppliers. These are often hidden behind user logins and offer a tailored experience rich in unique features, including customised account management, pricing structures and payment terms that cater specifically to B2B dynamics.

Why is B2B eCommerce important?

For businesses that trade with others, the streamlined features of B2B eComm are invaluable: automated data entry reduces supplier workload and errors; customers benefit from a user-friendly and visually engaging platform, enhancing their overall experience; and promotional capabilities are built-in, allowing strategic upselling. These platforms cater specifically to their customers, creating ease-of-use, brand loyalty and ultimately fostering a lasting relationship between suppliers and buyers.

What’s next in B2B eCommerce?

B2B eCommerce is evolving; we’re seeing a marked increase in the integration of B2C-like features including retail-style promotions, upsell and cross-sell functions, and loyalty programmes. The rise of B2B marketplaces like Upstock, Faire and Joor further emphasises the importance the market is putting on this area of commerce.

Customer account management is one area progressing most dramatically - basic, B2B-as-an afterthought-type functionality has been swallowed by the need for advanced features. These include elements like custom quotes, integrated marketing materials, sales rep activity and direct communication, as well as common B2C elements like tracking and tracing orders and payment options.

Where ALTSHIFT Plays:

ALTSHIFT / BDO Solutions works with all the B2B eCommerce platforms, including BigCommerce, Pepperi, Brandscope, SparkLayer (for Shopify), and Shopify Plus B2B, which we speclialise in. This platform requires minimal customisation and offers native Shopify functionality, making it ideal for those already on Shopify for B2C or POS. We have also created our own solution, which can be applied to any of the main eCommerce platforms or sit directly over the top of an ERP system. It’s platform agnostic with a custom front-end and no limitations on the number of features.

If you are interested in learning more about B2B eCommerce, drop us a line at admin@altshift.co.nz; we’d love to hear from you.

The Good Work: 7 Ways Technology Helps Not-For-Profits

Charities frequently exist on limited resources and budgets, so it can be a real challenge to keep up with digital advancements. We invest heavily in the Not For Profit space because we believe that the missions of these vital organisations should never be compromised by outdated systems.

7 Ways Technology Helps Not-For-Profits:

1. Governance

NFPs have a strong need for compliance, recording, reporting and transparency; processes made exponentially easier through modern platforms.

2. Cost Saving

Technology can help any organisation do more with less - charities can then reallocate budgets from operations to activating their actual missions.

3. Connection

Contemporary digital systems enhance the CX experience, building trust and credibility while minimising friction for donors, recipients, staff and volunteers.

4. Visibility

The NFP landscape can be competitive; charities need to keep up with their peers to remain in front of their donors.

5. Compatibility

NFPs need to be compatible with the cashless society we’re moving towards for many reasons: attracting the next generation of donors, lessening the administrative burden of physical currency, transparency, and convenience, to name a few.

6. Resource

Technology can help fill gaps in resources, which in the context of NFPs means more money and less reliance on staff and volunteers.

7. Automation

Automation can enhance productivity, reduce the risk of human error, save costs and set the charity up for scalable growth.

Where do we come in?

We’re proud to have helped a number of NFPs on their digital transformation journeys. With Fred Hollows, we implemented inventory, accounting and reporting systems to support international operations; at KidsCan, we conducted a finance review, ultimately bringing the function back in-house with new finance and admin systems; and, we focused on efficiencies and introduced state-of-the-art finance and payroll systems at the Burnett Foundation.

The work we do with NFPs is some of our most rewarding because we know that charities that leverage technology are better positioned to stay relevant, reach a wider audience and respond effectively to evolving challenges. Get in touch if you’d like to learn more.

WFMax Alternatives

It’s almost time for WorkflowMax to kick back, grab a piña colada and plan a golfing holiday because it’s retiring in June 2024. The good news is that there are plenty of really strong project management software options on the market, ready to swoop in and replace it. The challenge lies in figuring out which of the WorkflowMax alternatives is best suited to your business.

Here’s what we suggest:

Look at what WorkflowMax alternatives have been designed for your specific industry.

If you’re in professional services, you may look to a solution like Roll, a project management and collaboration platform that simplifies task tracking and team communication, or ProjectWorks, which has been designed to setup professional services businesses for scale. Those running trade services are more likely to find alignment with Next Minute, management software for the construction industry, or Fergus, a job management software tailored for trades and service businesses. There are WorkflowMax alternatives out there for all industries!

Narrow down your selection based on your business requirements and existing systems.

For example, Zoho Projects aligns really well with any business using Zoho’s CRM, syncing and integrating to ultimately supercharge efficiencies; Workguru is well suited for small and medium businesses, especially those offering trades or providing in-field services, like maintenance, repairs, or installations; and we find that GoJee is best suited for any business that offers custom manufacturing. Overall, Bluerock is the most like-for-like alternative to WorkflowMax, but unfortunately it’s not available until next year.

Talk to a partner.

Looking for an IT provider who is tech-agnostic, and therefore able to objectively provide recommendations after analysing your business. They should set you up to trial a couple of different options; you want solutions crafted around what feels most intuitive to you and your team. The partner should also be able to manage the entire WorkflowMax exit for you, migrating all of your existing data, setting up the new systems, training staff and providing ongoing support.

Mastering Workflow: A Guide to Choosing the Right Software

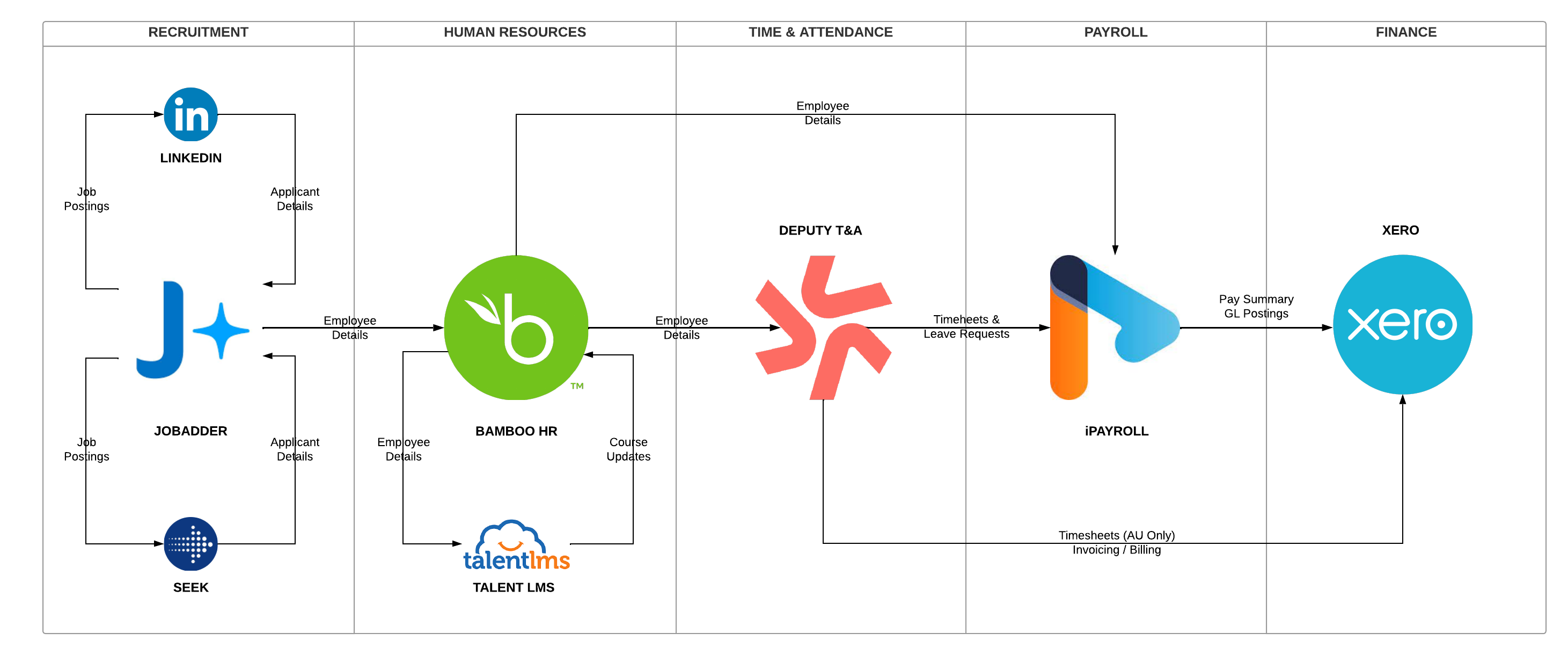

When it comes to selecting employee management solutions, it can be easy to feel overwhelmed by the multitude of options available. Here we break down how to choose and some platforms to know about.

How to Choose:

With market factors like increasing compliance requirements and labour shortages, it’s never been more important to choose the right workflow software. We recommend that businesses always start by mapping out the employee lifecycle from end to end. We then suggest reviewing what tools and resources are needed at each step. Two key things to consider are automation and ease-of-use; employees will be able to best utilise a system that’s engaging and straightforward.

Four Platforms to Know About:

As platform-agnostic providers, we can subjectively recommend which services can best suit your business. Below, we've rounded up some of our favorites:

- Deputy

- Offers powerful rostering and timesheet management for larger workforces

- Boasts strong awards management, e.g. overtime, additional entitlements

- User-friendly and engaging for staff

- Adapts to a multitude of industries, including healthcare, hospitality, construction, manufacturing and agriculture

- Bamboo HR

- Comprehensive HR management system

- Ideal for internal HR functions

- Rich in HR-specific features covering areas like recruitment, onboarding and certifications

- Built to seamlessly integrate with payroll, LMS (learning management), and time & attendance

- iPayroll

- Provides an outsourced legal service alongside the HR software

- Ideal for businesses looking to outsource the HR function

- Developed here in New Zealand

- PayHero & Droppah

- Ensures payroll compliance with the Holidays Act

- Integrates rosters and timesheets

- Ideal for SMBs with employees on variable hours

What’s Next?

If you’re interested in increasing your workplace efficiencies through software, drop us a line to connect. We’d love to discuss your options.

Choosing the Right CRM: A Crucial Tool for Business Growth

Customer Relationship Management software is a suite of cloud applications that collects and stores customer data, providing a central platform for sales teams to manage customer interactions and enhance customer experience. It essentially unifies sales, marketing, customer relationships and customer services, and as a result, the right CRM will, without a doubt, improve overall business performance. Think: better customer relationships, efficient lead management, sales automation, data centralisation, segmented targeted marketing, detailed forecasting and reporting, customer retention, scalability…the list goes on. It’s easy to see why it’s crucial to choose the right CRM.

Two of the major players in the space are Zoho and Salesforce, and it’s common for Kiwi businesses to feel confused about which is the best fit. They’re both trusted brands that offer feature-rich solutions though in our experiences, Zoho is often a better fit for our mid-market clients. Salesforce started with a focus on enterprise before including more SME-focused solutions, whereas Zoho has its roots in small and medium sized business, and therefore feels much more intuitive.

The CRM decision often boils down to finding the software that aligns with your company's needs while staying within your budget. Salesforce has an extensive array of features and integrations, numbering in the thousands, however, it's worth noting that even Salesforce's second most affordable option tends to be pricier than Zoho’s top-tier plan. Zoho also offers a free edition and flexible month-to-month billing, avoiding annual commitments.

While Salesforce offers a more extensive range of features, Zoho’s offering is still likely more than enough for the average small to mid-tier business. It integrates seamlessly with commonly used software platforms and has a built-in social media feature for tracking conversations on platforms like Google and Facebook. In terms of user-friendliness, Zoho is ideal for beginners and smaller businesses who want to get started quickly. Salesforce, due to its extensive capabilities, is more likely to need a professional IT team to oversee it.

Salesforce still may be the right choice for larger or more complex businesses. It offers many industry-specific solutions, like Salesforce Health Cloud for healthcare and Salesforce Financial Services Cloud for financial services, and extensive customisation options. It’s also known for its scalability and can accommodate the needs of large enterprises with complicated sales processes and data management.

If you are thinking about switching to a new CRM system, let’s chat. ALTSHIFT is the only provider that specialises in multiple products and we’re tech-agnostic, so we’re able to objectively tell you what your business really needs. We’re powered by BDO, so we use our deep knowledge in accounts to find the best solutions. Best of all? We’re there for you every step of the way, supporting your business and optimising it for better business decisions and scalable growth.

The Time is Now: The Power of Digital Transformation

In a world where business applications and automations have advanced further than ever before, a holistic approach to digital transformation is often essential for businesses operating on outdated legacy systems. There are a myriad of reasons why businesses are so positively impacted by making the switch; we look at three of the key ones below:

1. Cloud integration

This is the number one advantage of a digital transformation. The clue is in the name: cloud integration takes multiple platforms - from sales and customer service, to operations and logistics, to finance and accounts - and integrates them. In simple terms, the systems talk to one another.

2. Staff wellbeing

An integrated digital solution gives insight, transparency, and visibility across all departments, which positively impacts staff productivity and well-being. Clients we’ve led through these transformations report reduced staff stress levels, decreased burnout, and lessened pressure on staff. You can imagine how errors are reduced as many time consuming processes become automated, which naturally instills confidence and a more positive work environment.

3. Scalable growth

A digital transformation is proven to enhance data security, maximise supply chain efficiencies, revise energy consumption, support compliance, minimise risk and generate customer insights. Ultimately, it brings the business into the ‘now,’ driving its accessibility and compatibility, and optimising it for success in today’s digital-first landscape.

The most effective digital transformations are led by trusted partners with expertise spanning various disciplines like ERP, CRM and ECOM. Unlike some of the other players in the space, we firmly believe that partners should remain technology-neutral, giving them the ability to analyse the unique needs of each business before offering a tailored solution. At ALTSHIFT, we take this one step further with a team of in-house developers who are able to fine-tune customisation to the point where we can (and do!) create bespoke apps.

We appreciate that many operators feel overwhelmed by the idea of transforming all of the software across their business; with never ending to-do lists, it can be hard to imagine finding the time and energy to get started. That’s where we come in; BDO has powered ALTSHIFT to give businesses the ability to outsource the digital transformation process.

We work with businesses of all sizes and industries, successfully guiding digital transformation journeys for companies like RUBY, Medi Foods and Black Magic Tackle. We lead every step of the process, from initial analysis and solution recommendations, to migration and integration, to staff training and technical support. If you’re interested, email me on josh.ambler@bdois.co.nz and let’s catch up for a coffee to discuss.

Successful partnerships – a platform for business success in 2022!

Success in business hinges on working with - and knowing when to call on - trusted partners. And then, long term success relies on continued relationships with those who can adapt to change, consistently deliver and be depended on in times of need. Looking into the evolving business markets and economic uncertainty in the year ahead, we wish you the very best in your trusted partner relationships to help see you through – and if there’s a role we can play in your journey, we’d love to chat.

We’d also like to take the opportunity to acknowledge one of our own successful partnerships - with MYOB - and thank them for our recent 2021 Enterprise Partner Award; we believe stronger ALTSHIFT alliances (a division of BDO Information Systems) bring stronger capacity for us to deliver success for our clients. Lets talk about the range of ALTSHIFT partners we can connect you with in helping drive your business success in 2022!

How to scale your small business

A common misconception in the business community is that the “start-up” phase is typically the riskiest stage, when in actuality small businesses are at most risk of failing in their growth phase. With growth comes an increase in critical mass, significant capital investment and an increase in overhead costs. A business operating with more staff, more locations and more revenue shows growth on paper. However the truth lies in the Profit & Loss, this same example could well be making the same or less profit as before they grew with increased administrative burden. The most important thing to know when growing a business is the difference between growth and scaling; growth is an overall increase in critical mass, however scaling is an increase in sales while decreasing costs.

As a business owner, your job is to make calculated decisions while mitigating risk. The difficult reality for business owners is that even the most meticulously managed scaling costs money and capacity. When planning to scale up a business, the key is to assess the cost versus benefit of every decision to ensure that the returns on successful scaling are higher than the potential risks.

When scaling a product based business, close attention must be paid to cash-flow and the cash burn rate. Not every small business can afford a clever CFO to manage this perpetual machine, however negotiating better payment terms with your suppliers will help you increase your stock-turnover rate. If you can effectively forecast that you are going to sell around 25 widgets next month, and you negotiate for 30 day payment terms instead of prepaid, you will tie up no capital in that stock but still collect all of the profits.

Another tip for scaling a product based business is to introduce a wholesale channel to your operation. There are an array of risks involved with establishing a wholesale channel, thankfully with the right processes and technology you can get this up and running with minimal cost or disruption. Businesses who implement wholesale the right way will quickly see turnover and profits soar, and small businesses will commonly seek wholesale as a viable method of scaling. On the flip side, the implementation of an e-Commerce sales channel can also broaden your number of potential customers.

The common theme when discussing options for scaling with minimal risk is technology. The implementation of a cloud solution is the natural progression from manual record keeping like spreadsheets, and when configured correctly will provide you with the insights to scale your business; without the cost of installing an incumbent ERP system. ALTSHIFT has provided a platform for many small businesses to scale upon, and our expertise across many different industries and verticals will ensure we see you through your growth phase. Need a hand? Talk to the experts.

Effective demand forecasting models

Demand forecasting is the complicated science of hypothesising expected sales demand for a given product or series of products. Typically demand forecasting consists of assessing future demand based from historical sales data, and is used to aide businesses in making decisions on what inventory should be held to make best use of cash. The absence of demand based forecasting leaves businesses vulnerable to lost opportunities through stock-outs, or could leave your business with a surplus of stock.

Pursuing demand forecasting to maintain a lean inventory has a number of benefits, one being increased sell-through. Sell-through is the number of times inventory is bought and entirely sold in a given time period, the goal here should be to purchase and entirely sell the inventory of a given product within 90 days. Achieving this will result in reduced holding costs and increased cash-flow. Being able to effectively anticipate customer demand will also allow you to make smarter staffing decisions around providing resource to facilitate spikes.

One method of demand forecasting is a time series analysis, this method is best suit for businesses that have several years of sales data to work from. When trends are clear, businesses will use their historical sales data to get an idea of the seasonal fluctuations of sales volume. This method will work best where sales trends are relatively stable.

In the absence of historical sales data, a method called qualitative forecasting can be used instead of the time series analysis. The qualitative forecasting methodology is typically used with new businesses, or where a new product line is being launched. This method will typically use market research to make a hypothesis on forecasted demand.

A factor to consider when demand forecasting is seasonality. Seasonality is a characteristic where sales experience regular cyclical changes that recur over the calendar year (such as an increase in sales during the holiday season). Trends can also occur over time that signal a shift in behaviour such as a product increasing in popularity. When it comes to demand forecasting both seasonality and sales trends should be taken into account when hypothesising the demand of a particular product. This data should then be used to prepare your inventory, marketing activities and overall operational processes. By effectively forecasting anticipated sales of a particular product, you’ll be able to increase your sell-through rate and reduce stock-out scenarios leading to increased customer satisfaction.

Your business ERP system will be the starting place demand forecasting, as this is where most of your data lives. Having worked with wholesale/distribution businesses of all shapes and sizes, ALTSHIFT has successfully executed ERP projects that serve as the backbone to effective demand forecasting. Planning to implement a new ERP system? Get in touch for a free consultation.