Small businesses nurse $230k in pandemic stock hangover

Small businesses nurse $230k in pandemic stock hangover

A survey finds firms have thousands of dollars locked up in products accumulated when supply chains and transport networks were log-jammed.

Small businesses are nursing a stock hangover from the pandemic worth an average of $230,000 according a report by inventory management software specialist Unleashed.

Transport and supply issues during COVID had generated an oversupply and most SMEs had yet to course-correct, the company said.

“You can’t blame Australian businesses for taking on extra stock while supply chains were lagging behind,” said Unleashed head of product Jarrod Adam. “Thankfully, we are now in a place where we can safely define what too much stock is, and where businesses can afford to free up cashflow as economic conditions tighten.”

Unleashed analysed 148,142 products, ingredients and components stocked by 660 Australian SMEs and found an average of $231,700 in additional product or ingredients versus ideal stock levels. Ideal levels were calculated using industry-standard formulas that considered both the rate of sale and delivery lead times for individual items.

The figure varied from sector to sector, with personal care ($115,165) and beverage companies ($73,244) carrying the least overstock while

industrial machinery, raw material and equipment ($358,427), along with building and construction ($370,528) had the most.

Australian firms also had a higher average overstock position than those in NZ ($200,733) and the UK ($186,500) although were in a slightly better position than their North American peers ($236,391).

BDO senior manager Josh Ambler said high stock levels could creep up on a business due to a lack of visibility.

“Traditionally, there haven't been great tools to identify overstocks or under- stocks, or be able to order just-in-time. Typically, people developed their own logic outside of systems to try manage that,” he said.

He said that broad-brush approach of the past was being replaced by more detailed analysis and clarity about a firm’s stock level could make a big difference to its cash position.

“There have been three or four tools come to the market that can do that at a very affordable price and so it's changed the game for those small-medium wholesalers and retailers.”

He said some sectors, such as the wine industry, which had long experience with overstock had become good at dealing with it. However, sectors that operated on big margins or which relied on disposable income, such as luxury goods, could suffer.

“Comparing, say, beverages and construction, you’re often looking at very different inventory models. Unlocking cash from surplus inventory is way simpler if you have a short cashflow cycle – some relatively simple adjustments in resupply orders can quickly mean more cash in the back pocket,” Mr Ambler said.

“For businesses with a slow cashflow cycle, ordering will take place at set times or in higher volume to secure a good price. These companies may instead need to consider how they can move off excess stock before it comes obsolete.”

“We might see more businesses become made-to-order or what we've seen in the beverage industry, for example, is they don't hold any stock at all – it's all outsourced typically now.”

For photographic lighting retailer Hypop, this year has meant moving away from the just-in-case model used during COVID and back to just-in-time.

“During the pandemic our stock literally doubled as we tried to manage all of the delays from equipment purchased around the world — and sometimes that meant holding too much of the wrong thing,” said Hypop owner Rob Ranoa.

“This year we decided to start cutting down this excess inventory in order to move to a more stable operating model. That’s meant some sales and promotions, which can hurt in the short term, but leaves us in a far better position in the long run.”

Mr Adam said the report’s findings could make a real difference for businesses pressured by inflation and supply chain shocks.

“We know that unlocking cashflow is a priority for our customers ahead of this new financial year,” he said. “It's all about finding ways to control the controllables – that can mean anything from improving internal efficiencies, to using a more granular, data-based approach to rebuying.”

Mr Ambler said expanding sales channels was a key strategy for tackling too much stock, especially when sales were slowing.

“The advice has always been look for other channels to market and a really good one at the moment is Amazon,” he said.

“Amazon Australia is maturing rapidly and is hungry for unique products. People maybe create a white label of their product, or a slightly different brand version of the product, and launch them to Amazon. It might be slightly discounted but it helps get volume.”

He said it could also open up fresh markets, and Australian and New Zealand businesseses had successfully launched into the US using the online sales giant.

Other traditional strategies were being revived, such as wholesalers cutting out the middleman and going direct to market with online websites.

Mr Ambler expected stock levels to return to normal levels as demand eased.

“People have to get clever around reducing their stock holdings but they certainly won't be buying more than they need to,” he said.

“The supply chains are smoothing, freight charges are coming down, it's all falling back into a normal routine … and now we’ll see reduced demand.”

The Unleashed report looked at the stock positions of 1,886 firms in Australia, NZ, the UK, the US and Canada, and calculated optimum levels for 381,000 individual product and component lines.

All the firms analysed were manufacturers, manufacturer wholesalers or manufacturer retailers with less than US$25 million in turnover.

Unleashed is cloud-based software that gives product businesses clarity and control across suppliers, production, inventory and sales. Founded in NZ in 2009, it was acquired by the UK’s Access Group in November 2020 and has thousands of users in more than 80 countries.

Successful partnerships – a platform for business success in 2022!

February 18, 2022MYOB Advanced,Cloud ERP,ALTSHIFT,Business

Success in business hinges on working with - and knowing when to call on - trusted partners. And then, long term success relies on continued relationships with those who can adapt to change, consistently deliver and be depended on in times of need. Looking into the evolving business markets and economic uncertainty in the year ahead, we wish you the very best in your trusted partner relationships to help see you through – and if there’s a role we can play in your journey, we’d love to chat.

We’d also like to take the opportunity to acknowledge one of our own successful partnerships - with MYOB - and thank them for our recent 2021 Enterprise Partner Award; we believe stronger ALTSHIFT alliances (a division of BDO Information Systems) bring stronger capacity for us to deliver success for our clients. Lets talk about the range of ALTSHIFT partners we can connect you with in helping drive your business success in 2022!

Working Smarter With The Cloud

Through the lock-down many businesses have enabled remote working and realised the benefits of investment in technology. No doubt there have also been frustrations with working in a ‘paperless’ environment, accessing legacy technology and modifying historic business processes.

The ALTSHIFT team will discuss practical technology solutions you can utilise in your business to achieve smarter ways of working including;

eCommerce integrated to inventory and finance

eCommerce automation with shipping and tracking

Accounts payable automation

Automated debtor collection

Online reporting tools

Please watch the video below to find out more...

MYOB Advanced High Achievers

April 26, 2020MYOB Advanced,Cloud ERP

Last month (and before the lock down!) we were graciously hosted by the MYOB Enterprise team for their annual partner conference on the sunny Gold Coast. Apart from the stunning location we were treated to a series of workshops and detailed updates on the MYOB suite. From our perspective we were pleased to see the level of investment in the MYOB Advanced platform (there's no doubt this cloud ERP platform has a big future mid-tier market) and it was great to see a number of new 3rd party integrations on the scene adding to the breadth of functionality.

The conference closed in style high up on the 77th floor of the SkyPoint building (that's 230m in the air!) where as part of our partnership with BDO Information Systems we were pleased to receive the Excellence in Business Development Award for MYOB Advanced (NZ). For BDO Information Systems the award comes 2 years running and is a testament to the quality projects being rolled out by the team.

A great night was had by all and if not for that awful virus we'll be back again next year to defend the silverware. For now the team are head down in MYOB Advanced projects with a number of new sites going live in the new financial year and we're all thankful that we can continue to work in the cloud.

Ten Key Things to Consider When Implementing Digital Transformation

Data collection and analysis are integral to business success and growth, and most businesses have already adopted digital transformation strategies to ensure they thrive in competitive markets now and in the future. Digital transformation affects all aspects of a business, from digital marketing to business operations, so this transition process should be handled carefully. If you’re thinking of moving towards digitization, here are the key things to keep in mind to ensure digital transformation success.

Strategy. An overall digital transformation strategy must be in place to avoid using a shotgun approach or doing bits and pieces at a time. Strategy requires building a set of requirements tailored to your business’ needs and documenting them to create a brief.

Expertise. Consider whether you have the expertise internally to execute the strategy or if you need to engage with external contractors, partners, or experts.

Research. Gather information on products, platforms, and technology that might be considered as part of the transformation, e.g. different accounting platforms, e-commerce platforms, etc. Book vendor demonstrations and workshops if they offer that service.

Peer Review. Check vendor references, online reviews, and meet up with existing users. This way, you’re able to base your decision from a wider pool of experience and information.

Future-proofing. Make sure the solution you intend to adapt is future-proofed. Technology moves fast, so be avoid using software that's likely to become obsolete within the next few years.

Automation. Automation is an integral part of digital transformation. Ensure your solution can automate internal processes, fix any current problems, or remove a current bottleneck with little to no human intervention.

Insight. Consider whether the solution will provide more insight, analytics, transparency, or allow you to look at the business activity in a different way.

Budget. What is the cost/budget and timeline to execute the strategy? Consider 2% of turnover to be a good starting point for a digital transformation budget.

Delivery. Create a project plan with a clear sequence of events and designate a champion for the delivery. They must be responsible for executing the strategy—internally and/or externally.

Change Management. This is the human element of digital transformation. Managing change internally requires managing people's emotions and egos, gaining staff buy-in, and getting people on board with the strategy. Pre-empting human issues or resistance can make a big difference to the success of a project.

Attitude. As an extra yet essential step, it’s important to remain positive, seek out the positive benefits of change, and focus on what new opportunities the solution creates. Understanding the limitations of a system is important, but try not to critique it too much, as you will always find limitations with software. There is no perfect system. What’s important is that, overall, there is improvement, efficiency is gained, and/or it solves more problems than it creates.

ALTSHIFT provides professional support for optimizing business information systems. If you require professional advice regarding your business information systems, reach out to the ALTSHIFT team today. Our trained experts, practitioners, and consultants understand that powerful information systems ranging from inventory systems to workflow are behind every leading business.

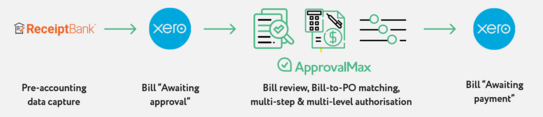

Simple yet robust - an automated expense entry and approval process for Xero

With a huge up take of Xero these days many clients are taking the next step to further automate their systems. Although Xero itself has some basic ‘approval’ functions, often this is not enough for a business complex approval workflow.

Examples include:

Branch managers only want to approve bills for their own branch

Managers or CFO’s need to approve bills over a certain limit

Requiring more than one person to approve a bill

Having an approval delegate when a manager is on leave

Sending automated reminders to managers when they bills to approve

Or any combination of the above!

With a tool like ApprovalMax, businesses using Xero can have these complex approval workflows and digitize them for the modern era, keeping a digital audit trail and removing unnecessary paper and printing from the process.

Furthermore tools like Receiptbank remove the data entry from the beginning of the process (receiving the bill and have it auto-entered into the accounting system with appropriate coding).

With the 2 combined processes moved into the cloud, you have digitized the entire accounts payable process from start to end!

We’ve joined forces with BDO!

We are very excited to announce that from the 1st of June 2019 we are merging with BDO Information Systems Ltd.

Who is BDO and why did we decide to join them?

BDO is a global accounting and advisory firm with offices in 162 countries and the leading SME accounting firm in New Zealand. BDO Information Systems is an independent division of the BDO group that specialises in cloud software solutions. This merger brings together a wealth of expertise and gives us greater capability to provide a better service to our clients.

What does this mean for you?

Your current relationship with ALTSHIFT will not change. We will continue to offer the same services at the same rates, from the same key people. What it does mean is that you will have access to a bigger team of specialists who have vast experience working with a wider range of cloud based solutions. We think that together BDO and ALTSHIFT have an unmatched level of expertise when it comes to your business systems and we hope you continue to support us on the next stage of our journey.

If you have questions, please get in touch.

Josh Ambler & the ALTSHIFT Team

Celebrating the launch of BNZ MyBusiness Live

In anticipation of the launch of BNZ’s new MyBusiness Live Dashboard (powered by 9Spokes), ALTSHIFT was invited to Wellington to represent TradeGecko at a networking event designed to connect app partners of the 9Spokes eco-system with senior BNZ partners. With the uptake of cloud software in business, BNZ is at the forefront offering a free BI dashboard to BNZ and non-BNZ customers alike.

The MyBusiness Live Dashboard allows you to easily connect a wide array of cloud systems which enables business leaders to configure an array of widgets to display key performance metrics. This in turn provides valuable insights that would otherwise take months to prepare; at the click of a button. Business leaders who utilise MyBusiness Live will have the data to monitor the vital signs of a business that may otherwise be missing from the P&L, leading them to make smarter business decisions.

Among ALTSHIFT and TradeGecko, we were joined by other apps from the 9Spokes/MyBusiness Live eco-system. We had a wonderful time networking with the folks from apps such as Xero, MYOB, Tradify, Shopify, Exsalerate, Hedgebook, Debtor Daddy and Business Sorter.

Client Spotlight: Our Time with Epiphany

Epiphany Cafe is a steadily growing franchise of cafes headquartered in Te Rapa, Hamilton. With 8 locations (and more on the way) they are steadily acquiring a cult following with their Donuts, Muffins and Scones. They are moving into a brand new factory to keep up with demand, and as a part of this process they also made the conscious decision to implement back-office systems to serve as a platform for their future growth. Upon meeting with Epiphany for a consultation, it was decided that Unleashed would be a fantastic candidate for them to manage their production supply-chain. Unleashed is a powerful inventory and production management system that tightly integrates with Xero, it is our system of choice for food & beverage manufacturers (our other F&B clients such as Sal’s Pizza and North End Brewery also use Unleashed).

Implementing Unleashed for Epiphany was no small feat, with many moving parts in the wider solution. One problem Epiphany faced was that their pre-existing process for franchisee ordering was riddled with time consuming manual data entry, something that was not scalable. As a solution to this problem, we implemented the Unleashed B2B Portal to streamline this process. Franchisees can now log in and place their daily orders seamlessly, and thanks to the B2B Portal we eliminated the manual data entry aspect of the ordering process. Since all of the food items Epiphany produces are made to order, each order gets consolidated at the finished good level ready to go into the Unleashed production module. Since we loaded Unleashed up with the recipes for each item Epiphany makes, head office is then able to quickly determine whether they have enough raw ingredients to complete the day’s production run (and easily send out a purchase order to replenish inventory if needed). Another complex requirement of Epiphany’s was the need to track every batch of Donuts they send out, from the finished good right down to the milligrams of food colouring they used. If there was ever a problem with a batch of Donuts, they needed a full audit trail of each ingredient that went into the batch and whom the supplier of each ingredient was. Unleashed makes simple work of batch tracking for compliance, and offers Epiphany the peace of mind that they have full control over their batches.

Once we had taken care of the extensive data and configuration work to get the organisation ready for Unleashed, we began with running on-site training sessions to get the business ready for go-live. The purpose of the training is to ensure that every staff member knows how to leverage the system. We did training sessions split across two days, the first day for back-office processes and the second for the production module. Once training was complete, we were present for the scheduled go-live day in the new system. ALTSHIFT believes in mitigating go-live day risk by having consultants on-site in case of any hiccups.

Going live in a new system is extremely risky business, but with the execution of a specific sequence of events disaster can be averted. Careful project management is the key to a successful software implementation as well as ongoing support post go-live. ALTSHIFT is a specialist in managed systems implementation, we have delivered countless cloud-based solutions to business across many industries. If you are in the process of comparing different software solutions, get in touch with ALTSHIFT for a vendor neutral assessment of your specific business requirements.

Why should my business use a 3PL?

One of the most complex components to effectively scaling up a business is the management of an efficient supply chain. As a product-based business grows, so too does the throughput of product through an ever thinly stretched supply-chain. All of the moving pieces in your supply chain must continue to operate in perfect alignment to avoid bottlenecking in process, and unfortunately in the costs associated with deploying a new fulfilment/dispatch location can be quite high. Thankfully the option of utilising a third party logistics partner (3PL) exists.

3PLs are uniquely positioned in the fulfilment space in that they are equipped with the knowledge and resources for businesses looking to expand their reach (whether within their existing territories, or into new ones). One of the advantages of using a 3PL is the sharing and distribution of costs among partners. Simply put, instead of your business paying for an entire facility, your business is able to use the space in the facility that it requires. This way your business is only paying for what it uses. This aspect is particularly useful if your business has regularly fluctuating inventory levels (selling seasonal stock being the example). Other costs associated with warehousing such as labour are proportionately distributed among the 3PL’s clients. If your business cannot keep a warehouse full of product year round, this makes partnering up with a 3PL a very cost effective option.

Another reason to partner with a 3PL is the ability to leverage their international reach. As opposed to investing in a warehouse in a foreign territory and shouldering the burden of operating a warehouse in a country with different regulations and currency, you could partner with a 3PL that has locations globally and leverage their local know-how in the territory you want to expand in. To increase service levels and reduce costs, it is essential to have your product based close to where your customers are. Engaging with a 3PL is typically done so on a contractual basis, meaning visibility at a transactional level. This holds 3PLs to a much higher degree of accountability with tracking of key performance indicators.

Naturally, switching to a 3PL blazes a path for the automation of the fulfilment and dispatch functions of your business. This extensive automation frees up staff to perform higher value tasks. In order to achieve this, it is key to have the right technology and business processes in place to facilitate this. ALTSHIFT has consulted upon and executed numerous extensive cloud ERP implementations, which have included platform integrations to 3PL partners. The scope of these integrations include automatic fulfilment of e-Commerce orders, fulfilment of wholesale orders and more. Have a question about your systems and scope for 3PL integration? Have a chat with the experts.